What are the results if they bring extra cash as compared to consumer owes?

The Department from Experts Items does not require Va borrowers so you’re able to have a keen escrow account for their property taxation and insurance premiums.

However, extremely lenders manage require it because a condition of your own mortgage. This is because it offers a supplementary layer out-of protection to have the lending company. By ensuring that possessions taxation and you may insurance costs are repaid to the date, the lender should be confident that the house doesn’t fall to your disrepair otherwise deal with courtroom issues that could impact the loan’s really worth.

That do I Pay Escrow so you can?

Va borrowers pay their third-people Virtual assistant financial, a lender that is authorized by the Virtual assistant in order to originate and you will manage Virtual assistant finance. These types of 3rd-party loan providers render Va loans to help you qualified veterans, active-obligations army professionals, and their group. These businesses commonly associated with brand new Agencies regarding Veterans Situations but are passed by these to promote Virtual assistant financing. He could be generally speaking personal creditors like finance companies, borrowing from the bank unions, and mortgage organizations.

When borrowers located a good Virtual assistant mortgage out of a 3rd-group bank, they are guilty of and also make their mortgage repayments straight to the latest lender. The lender spends this new costs to purchase dominant, attention, fees, and you may insurance policies towards the assets.

In the event that a lender mistakenly requires extra money about debtor than it are obligated to pay, the fresh new debtor should get in touch with the lending company instantaneously so you’re able to fix the situation. The lender is required to refund people overpayments toward debtor. Yet not, in case your debtor owes more funds than they installment long rerm loans no credit check Riverside MD paid back, they’ll certainly be accountable for paying the leftover equilibrium.

Do Va consumers get that money back at the end of the year?

At the conclusion of the season, lenders can get situation a reimbursement in the event your borrower overpaid its escrow account, which is used to blow possessions taxation and you can insurance premiums. This new refund is generally awarded contained in this 30 days of your prevent of the season.

Is also Escrow be Waived on good Virtual assistant Financing?

In some instances, Va lenders may create consumers so you can waive a keen escrow membership. Although not, it is not a familiar habit, and Virtual assistant financing consumers need generally speaking see specific standards so you’re able to qualify. Such as for example, individuals may need a premier credit rating, a decreased financing-to-value ratio, and you can a hefty down payment.

You will need to keep in mind that waiving a keen escrow account arrives which have certain threats. If the individuals neglect to pay their house taxes or insurance premiums timely, they might deal with later charge, penalties, plus foreclosure. Instead of an enthusiastic escrow membership, the fresh new debtor tends to make such payments to the right events.

The conclusion towards Escrow to have Virtual assistant Funds

An escrow account is not required to take out a beneficial Virtual assistant mortgage, however, lenders recommend this so as that your house fees and you can insurance fees was repaid punctually.

As the a note: an enthusiastic escrow account are a special account stored of the a 3rd cluster, particularly a financial, that accumulates and you will pays specific costs with respect to the new borrower. This includes assets taxation, insurance fees, or other costs associated with the property.

When you find yourself good Virtual assistant mortgage borrower and just have questions about escrow account otherwise be it essential the loan, you need to confer with your lender. They can promote more information in regards to the specific conditions to suit your loan which help you understand advantages and you may dangers of using an escrow membership.

Ultimately, whether to explore a keen escrow membership is actually a personal choice that needs to be made based on your own personal means and you will finances.

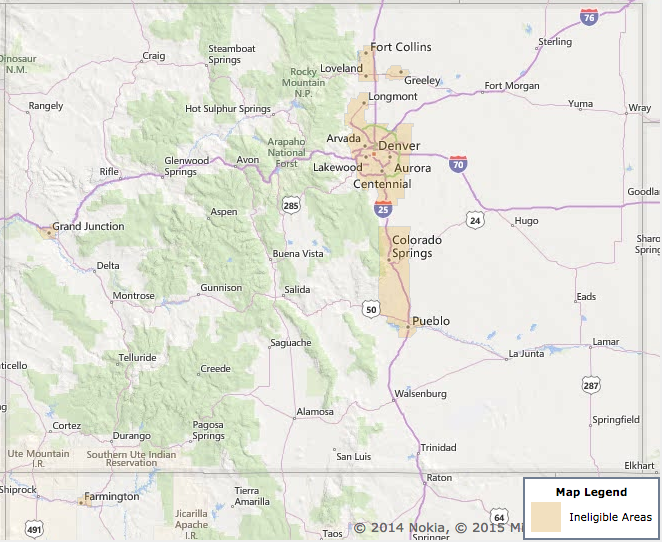

Va Mortgage Limits having 2024

Virtual assistant finance arrive up to $766,550 for the majority elements but could surpass $step 1,000,000 for single-family members house into the highest-rates counties. Assess the Virtual assistant financing restriction to see your own personalized financial limitation. Mortgage constraints do not affect all of the borrowers.