Leverage Your propertys Worth: Exploring the Benefits of Family Equity Finance

Homeowners increasingly check out house security money once the a viable solution to access money for several objectives. Leverage brand new collateral in your home provide a very important resource out of financing to own biggest costs like house home improvements, debt consolidation reduction, studies will set you back, if not doing an alternative business enterprise. Let us familiarize yourself with the advantages of home security financing and you may assist you on what to search for when looking for best loan.

A far greater Comprehension of Family Security Funds

A home collateral financing, called the second mortgage, allows residents to help you borrow against brand new collateral he’s manufactured in their house. Collateral refers to the difference between the market industry value of your own family while the leftover equilibrium on your own home loan otherwise liens. By leverage which guarantee, you can secure a loan which have beneficial words, so it is an attractive selection for of several residents.

cuatro Larger Benefits associated with Domestic Security Money

- All the way down Interest rates: The initial great benefit away from home guarantee money is the normally all the way down rates of interest than other kinds of borrowing from the bank, such as for example personal loans otherwise credit cards. Because your residence is guarantee, lenders imagine home security loans safer, resulting in a lot more beneficial rates. This leads to reasonable coupons over time, especially when compared to high-interest charge card debts.

- Access to a massive Sum of money: Domestic security finance will give homeowners the means to access generous quantities of money. The borrowed funds count is based on activities like your borrowing record, income, together with security you really have built in your home. Therefore, home collateral money was an ideal choice having high expenditures, particularly money a good little one’s studies otherwise carrying out detailed home renovations.

- Income tax Deductibility: With respect to the specific utilization of the funds, the eye repaid to the a property collateral financing is income tax deductible, at the mercy of certain constraints and standards. This tax virtue normally then reduce the energetic price of credit, and make domestic equity funds significantly more glamorous out of a monetary angle. not, it is very important speak with an income tax top-notch to understand this taxation effects to suit your needs. According to the Irs, financial notice towards a property guarantee mortgage are taxation-allowable if for example the borrower spends the bucks buying, generate or boost property. However, any domestic equity loans useful for motives other than the individuals acknowledged of the Irs commonly tax-deductible. Tap to see much more throughout the Internal revenue service to the tax deductibility.

- Flexibility inside Usage: Rather than certain kinds of fund one restriction the money can be be taken, domestic collateral fund promote independence in the using the borrowed currency. If or not you ought to consolidate highest-notice expenses, invest in a corporate, otherwise coverage medical expenditures, a property equity loan enables you to utilize the loans while the you will find fit.

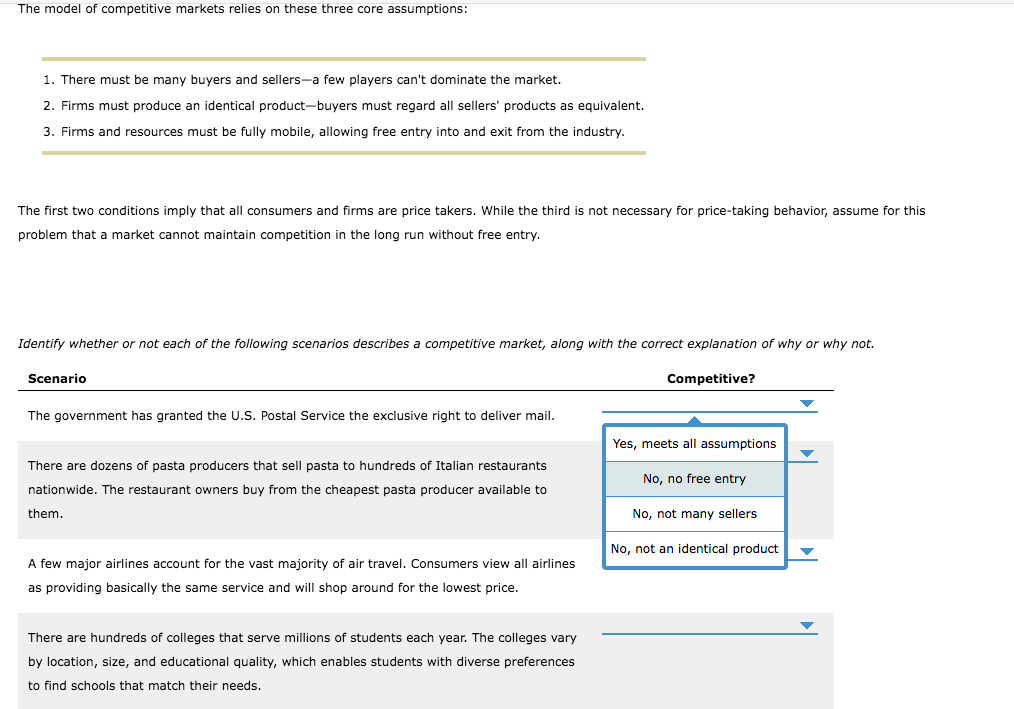

What you should See When searching for a property Equity Financing

- Competitive Interest levels: Rates may vary somewhat ranging from loan providers, thus doing your research and evaluating pricing regarding various other financial institutions are important. On top of that, believe whether or not repaired or changeable rates of interest will be considerably better to your requirements. Always think that the regional borrowing relationship now offers competitive pricing to the household guarantee fund.

- Good Financing Conditions: Cautiously remark brand new small print of one’s financing, such as the fees several months, monthly obligations, and you may any related fees. Ensure that the mortgage conditions try down and fit inside your finances. Pay attention to potential punishment to own very early fees or one invisible fees. Large charges can easily outweigh the www.elitecashadvance.com/personal-loans-nc/milwaukee/ advantage of a lower life expectancy interest rate.

- Loan-to-Really worth (LTV) Ratio: LTV proportion is the portion of their home’s appraised really worth you could potentially borrow against. Additional loan providers might have varying LTV conditions, with a lot of giving loans up to 80% of appraised value. Dictate your necessary loan amount and ensure it drops in lender’s acceptable LTV ratio.

- Reputation and you may Customer care: When deciding on a loan provider, think their profile and you will customer support track record. Discover online feedback and you will studies, seek recommendations off respected provide, and you can look at responsiveness in order to inquiries. Working with a reputable bank provide reassurance throughout the mortgage process. Borrowing unions put the members very first, always providing the large level of support service.

The key benefits of an excellent Guthrie Society Borrowing from the bank Union Household Guarantee Loan

Leverage brand new guarantee of your home compliment of a property equity financing shall be a prudent financial choice. Many advantages of household collateral finance were lower interest rates, entry to good funds, potential income tax advantages, and you will freedom from inside the incorporate. Although not, conducting comprehensive search, comparing financing now offers, and due to the specific things that line-up along with your monetary demands is essential. Performing this allows you to maximize the many benefits of a property security mortgage and you will secure a finance alternative that fits your unique requirements.

Guthrie Community Credit Commitment even offers members property guarantee financing with a great well low rate without settlement costs.* Tap to apply for a beneficial Guthrie CCU domestic guarantee mortgage otherwise for more information.

Seeking to tap into their residence’s guarantee in order to up-date otherwise upgrade? Realize our very own web log 2023 Home Upgrade Trend with high Return on your investment.

*Settlement costs are waived unless of course the borrowed funds is discharged within step 3 numerous years of the fresh origination time in which case you was needed to spend settlement costs, and this add the second: identity research, flood dedication, tape charges and you will appraisal. Subject to registration, credit and you may property recognition. Nyc State financial fees do apply. Some limitations implement.