What are the advantages of choosing a connection financing getting an excellent home?

To invest in another residence is a vibrant campaign with quite a few moving parts. First, you really need to find the right new home for the ideal speed in the best source for information at correct time to you personally plus relatives, then will come the requirement to manage mortgage loans, inspections and you will negotiations. Since the house are the best and you may costly affairs the average person is ever going to very own, securely controlling your property loan is probably one of the most important matters you do. And it also most of the begins with having sufficient bucks to possess a down percentage, settlement costs, name fees and so forth.

Many people be prepared to do a little rescuing just before they purchase an excellent home. Or, once they currently individual property, want to offer its current home prior to they get a unique that. That will imply plenty of waiting, yet not. Imagine if you discover the best house and wish to act today you do not skip your chance? Are there other options? I to be certain you there are.

Probably the most prominent choices try a bridge financing, and it’s really an ideal choice while you are expecting an increase from money in the future, either off a home income or another https://clickcashadvance.com/loans/loans-by-phone/ windfall. At the Solarity Borrowing Partnership, i endeavor to let homeowners reach homeownership fundamentally along with less roadblocks. On this page, we are going to speak about whenever ‘s the right time to use a link financing having property, what the great things about bridge finance for homes is actually, what the cons become and you may what other choice might be offered.

What’s a link mortgage having a home?

There are many reasons you could be looking to come in sufficient currency and make a good deposit towards the yet another family, for example an intend to promote your business otherwise current home. But what happens when you don’t need to those funds yet, while have costs that have to be secured? Namely, while you are to shop for a home, you desire money to make a down-payment.

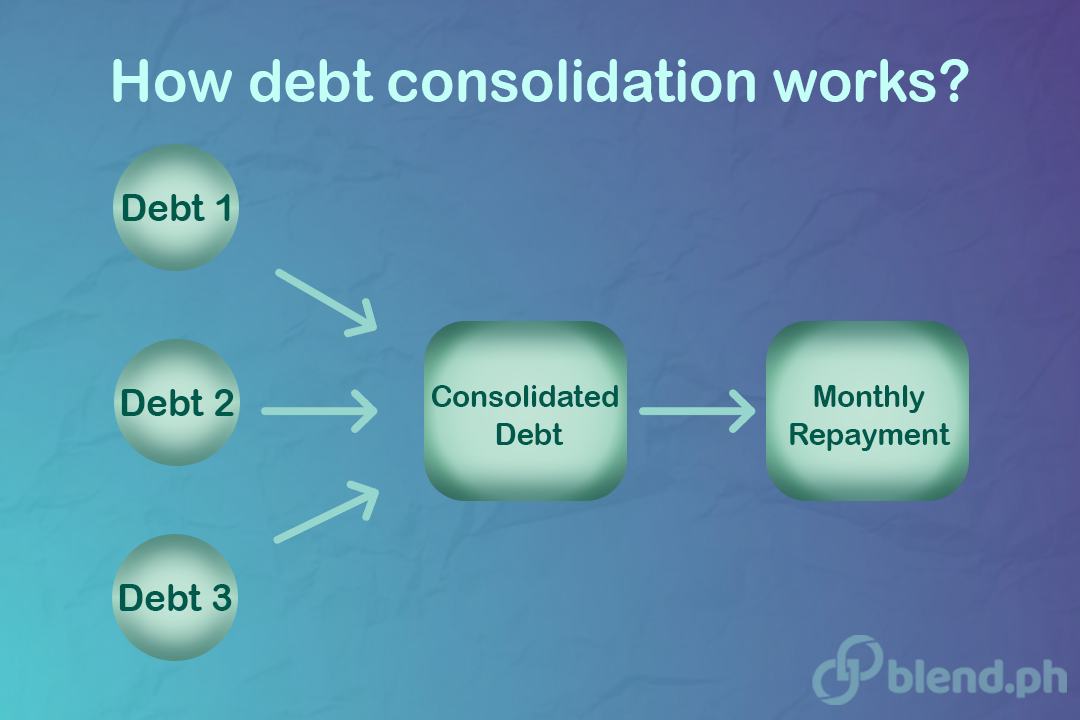

And here a bridge financing is useful. Bridge loans is small-name money that may be gotten quickly. Simply because they has actually highest rates of interest, this new presumption for link financing is that you grab you to away so you can rapidly obtain the liquidity you prefer and pay it off as soon as possible once the questioned increase of money will come into the regarding the deals of your own current family.

Simply put, a connection financing can be acquired since the the purpose is always to bridge a gap ranging from hopes of funding which money coming to fruition.

Benefits and drawbacks of utilizing a bridge financing getting property

Connection finance have many spends based on who’s seeking to all of them. Perhaps one of the most common is actually for home owners seeking to transform land through to the sale of their newest residence is done. There are positives and negatives of utilizing a connection mortgage inside that way. Why don’t we look closer at those dreaded.

Link mortgage pros

Lending establishments will take care of bridge loan requests easily because they are big date painful and sensitive. This is why, they can be a little simpler to get approved than prolonged-name funds, plus the money would be on your family savings a lot faster.

A new work with is the fact connection money often have reduced monthly premiums. Monthly link loan money are only meant to wade on the loan’s attract, causing them to smaller than a typical homeloan payment. The borrowed funds dominating is anticipated are reduced into the a swelling percentage in the bottom whether your financing gets offered. Actually, certain bridge finance don’t have any monthly payments at all and simply want the principal and you can appeal getting reduced within the a lump sum payment to one another. Ask your lender what your choices are.

You can find link financing that need you to shell out both the dominant and you can need for monthly installments, hence commonly beon the higher avoid of your spectrum. This new upside is it form you get to continue a lot more of the bucks from your eventual domestic business.

Connection financing drawbacks

Link finance generally have large interest rates. While many finance has interest rates regarding the mid/low solitary digits, bridge funds may have interest rates of 8.5% up to ten%. However, due to the quicker identity, the fund won’t have the ability to compound all the way to they could having lengthened-name funds such as for example mortgages.

Still, connection loans are not the type of funds you want to linger getting several ages, therefore you should only take all of them aside if you’re sure the financing may come owed easily.

Solutions so you’re able to connection fund for home

When you find yourself bridge funds are particularly smoother, they actually do features relevant fees using them, together with high interest levels tends to make residents and you will possible homebuyers skittish. In addition use your established house (that is to say, your property) once the security, if you never result in the money with the highest desire, you can cure your property for many who standard. Speak with an expert making you will be making a knowledgeable decision to suit your condition.

Home-equity finance let you use a lump sum in the guarantee you possess on your own established family. These can take more time as recognized as compared to a link financing, nonetheless possess down rates.

A house equity personal line of credit (HELOC) is a lot like property equity financing in that you are borrowing from the bank money from the security you possess on your latest family. Although not, rather than the lump sum payment away from a house equity financing, it line of credit enables you to borrow funds as much as an effective particular restriction, you just need to use what you would like.

The specialist Mortgage Instructions are here to assist

There is nothing the house Loan Books love more than seeing members move into their fantasy residential property. We’re right here to save anything as simple as possible (in addition to a totally on the internet but really individualized techniques)!