As the interest rates go up, a history-resort want to reduce house-loan costs

Key points

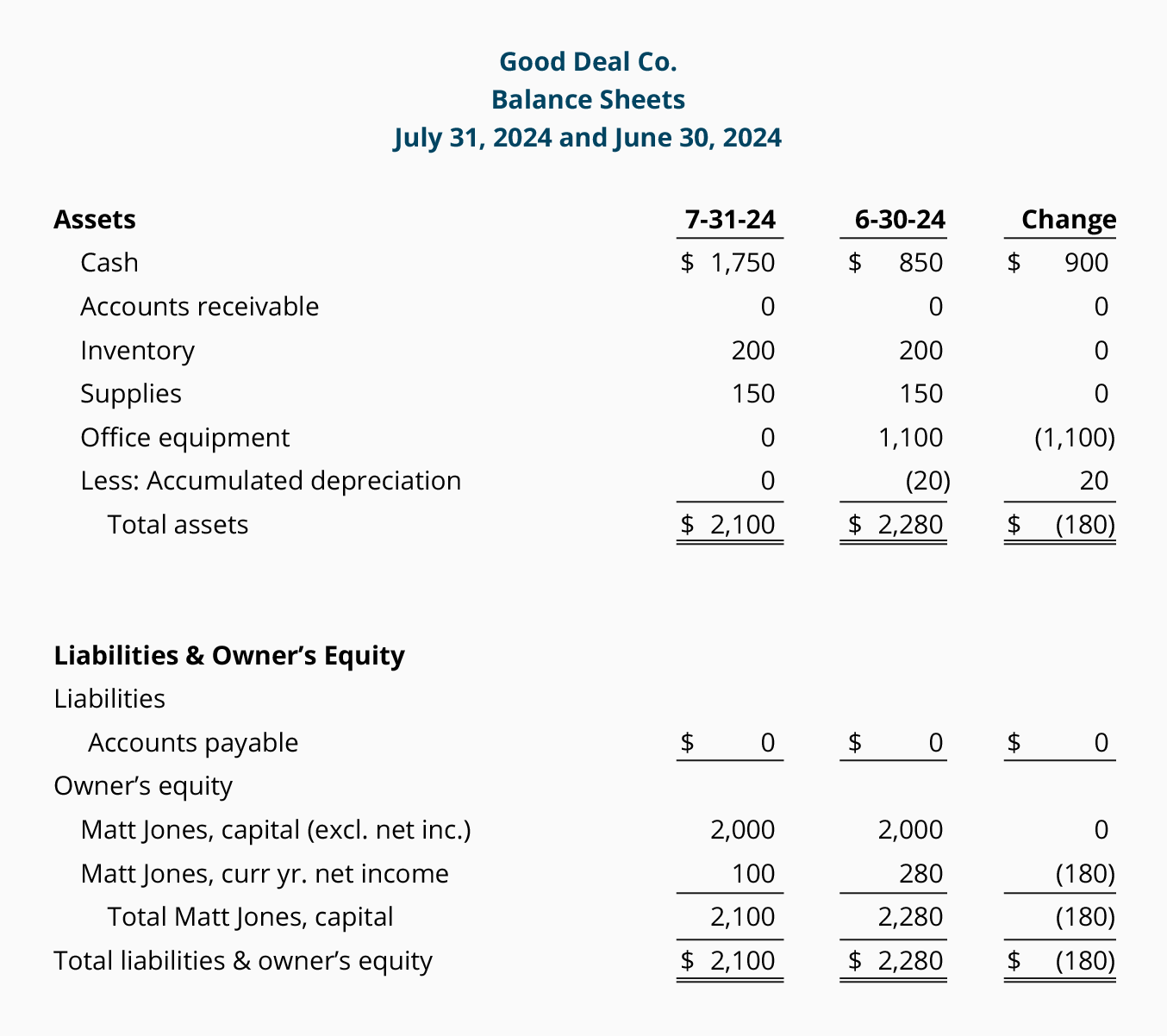

- Switching to desire just could cost some body that have an effective $one million financial and extra $39,058 across the longevity of the borrowed funds.

- Providing a less costly price saves the same number towards month-to-month fees while the an interest only loan.

- Switching to attract only is to simply be complete once tiring best alternatives, advantages state.

Possessions posts

Longer people are usually asking on altering element of their residence financing so you’re able to smaller desire-only payments, however, advantages urge caution regarding new strategy.

After 10 straight rises about bucks rate at this point, regarding the 880,000 lower repaired-price mortgage loans are caused by roll regarding this present year, tipping customers onto large cost that may increase their month-to-month mortgage repayments and you may squeeze house finances.

Choice can sometimes include refinancing that have an alternate lender to acquire an excellent lower price, stretching the borrowed funds term to take down costs, otherwise altering from dominant and you may desire repayments so you’re able to interest merely.

Using a destination-only mortgage perform help save $460 per month to have an owner-occupier with twenty-eight decades kept on the $750,000 home loan, RateCity modeling shows.

The brand new disadvantage is they perform spend an additional $31,294 during the desire across the life of the loan, and if the brand new debtor changes returning to a principal and focus loan in two age.

Refinancing to a less costly interest was a very glamorous choice, most of the getting equal. It can help save an equivalent homeowner $633 30 days and you will $19,225 over two years.

RateCity look director Sally Tindall told you applying for a less costly rate or refinancing is the greatest choice, if at all possible.

It might not match every home owners, like those who found at the property market’s top and you may might be during the financial prison.

Home loan jail is when a debtor try not to refinance because they never show they may meet with the money if interest rates flower a separate step three percentage factors, or as their domestic has fell up to now in worthy of they is really worth less than its a great loan equilibrium.

Whoever is actually financial prison and cannot re-finance have to adopt notice simply otherwise part money, she said. They should be haggling and their bank in the first instance.

The absolute final measure might be extending living off a beneficial loan, which Tindall told you is a bad financial choice.

They might wind up choosing to extend the financing name, which is a very costly do it and if at all possible will be prevented, she told you.

The audience is seeing men and women are inquiring us if we can button about part of the loan in order to focus-merely, he told you. The interest rate you pay towards the an attraction-just loan is far more high priced.

Lenders is fairly reluctant to allow it to be manager-occupiers to improve to help you an interest-only loan as it could feel a respected indicator which they can’t afford that loan.

The lending company regulator clamped down on appeal-just financing inside 2017 in the event the possessions markets is actually roaring, which it seen as greater risk.

CoreLogic direct out of Australian home-based browse Eliza Owen said it actually was most likely lenders carry out seek to help property owners continue to shell out their mortgages, as opposed to bring about swells from distressed offer-offs.

He’s a share regarding the possessions [we.elizabeth. mortgaged land], so to own way too much degrees of distressed offering carry out reduce steadily the value of these types of property throughout the years, she said.

I have not viewed anywhere near this much worry clear from the higher-height metrics, she told you. I do not find this being an incredibly common alternative; my personal suppose are people will avoid it if they can since of your additional cost along sites for loan in Security Widefield Colorado the longevity of the borrowed funds, however it is sorts of soothing you to definitely that kind of self-reliance is actually readily available.

Promote Ramsay Funds director Chris Foster-Ramsay imagine attract-just fund is a greatest services getting banking institutions and you may individuals across the the coming year.

Switching to that loan having a diminished speed – preferably – is nearly usually a better bargain in the end. Credit: Peter Rae

It’s getting increasingly crucial that you individuals who are interested in costs tough, he told you. We anticipate that maybe some of those financing recovery products throughout COVID to have users having issues next are likely to get back, but into the a case-by-situation base.

However, it wasn’t as easy as inquiring to go on to an interest-only financing in the event the a debtor envision it could conserve all of them an excellent couples cash for the short term, Foster-Ramsay told you.

First, loan providers would query borrowers to make use of any extra repayment money, go through the members of the family funds, prompt a switch away from monthly to help you a week otherwise fortnightly costs, and supply financial help.

Tindall told you those individuals provided relocating to appeal-only would be to disperse back again to a principal and focus financing while the soon to.

explanation

An early style of this post misstated the name of company in which Clinton Seas is a movie director. Its Axton Funds.