One-time Personal Structure Money versus Two-time Romantic Construction Money

Home-based build financing has smaller mortgage terminology you to vary from six months to a few ages, when you’re industrial structure loans have extended terms that expand to decade.

Home-based design finance are believed safer than just commercial construction loans, and as such the eye rates within these loans was lower than simply its industrial equivalents. To have home-based structure financing, the latest borrower’s creditworthiness, earnings and you will ability to repay the loan certainly are the attract to own structure loan companies, while which have industrial framework loans, the effectiveness of the project is vital.

Onetime Romantic build money, also known as unmarried romantic money, keeps just one closure procedure. The building mortgage and you may permanent financial support would be given to the latest debtor immediately. Given that structure loan is performed, it will become a long-term mortgage. The many benefits of this is actually your debtor has only one to band of settlement costs, you will find quicker documentation and they’re only speaing frankly about you to financing. Consumers must build focus-merely payments to the design phase as well as the prices usually are locked in early in the mortgage.

Two time Intimate build finance, since term means, need one or two independent mortgage closing approaches for the construction mortgage and the standard home loan. The building mortgage will need to be paid down in full once the construction is complete, and you will a new mortgage must be started having permanent funding after that. This type of finance also offer desire-just costs into the design phase however borrowers do not secure the interest rate to your permanent financial initial, and therefore can fluctuate according to the markets.

What exactly is A finish Financing?

An avoid loan is actually financing made use of in latest stage off a bona-fide home purchase, and it is accustomed pay off a short-term structure loan or other brief-name capital choice. Immediately following people have discovered the credit so you can release their structure investment, they can play with a conclusion loan to begin repaying their mortgage.

Inside the design phase, individuals are usually just repaying the interest towards the money. Yet not, while the opportunity is completed, the main loan amount must be paid. That is where consumers will find a conclusion mortgage to change the building mortgage, while the end mortgage may serve as permanent money toward possessions to pay off the borrowed funds entirely.

Prevent funds may have fixed otherwise variable interest levels and terms and conditions include fifteen to help you three decades. Since the end financing has been secure new borrower have the property transmitted completely into their label when they intend to hold on to the home, as an alternative the end loan would support new product sales of the house.

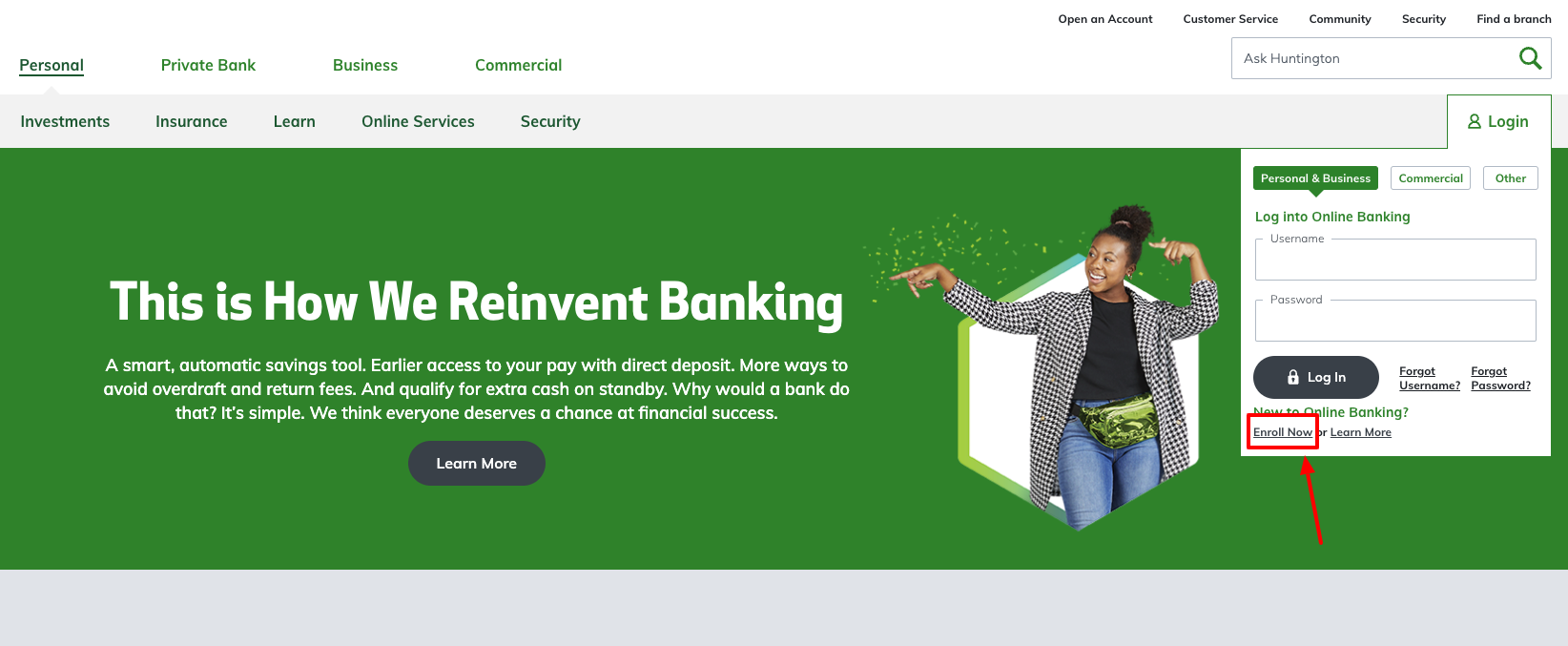

Just how to Make an application for A casing Mortgage

Applying to get a construction financing will likely be an in depth processes but listed below are some strategies to assist borrowers towards techniques.

Step 1: Find An authorized Builder

A button part of the whole process of signing up to get an excellent framework loan, is to find an authorized and you may reputable creator. Construction loan payday loans Candlewood Isle companies need guarantee that chosen builder is efficiently finish the home design. It’s best to evaluate some designers to find the blend of costs and you can ability you to definitely aligns with your conditions.

Step two: Prepare your Documents

The newest records try to get ready should include a distinctly outlined structure bundle you to facts the kind of property you plan to create or renovate, investment extent, funds, and you will timeline. Additionally, you will need to ready yourself all other data that picked lender means, including monetary files which imply that you can pay off the fresh loan.