Our unique strategy with these local rental assets loans in the Colorado, however, has the benefit of people more funds circulate options

DSCR loans enable dealers to help you influence the money is born the financial support services to help you safer funding getting possessions instructions

- Our traders like that it, since they are in a position to pull out all of their cash out they might keeps about assets, and even more for another contract.

DSCR financing permit buyers so you can influence the money is due its financing properties in order to secure funding to have possessions sales

- I take on aggressive costs compared to conventional loan providers!

DSCR financing permit investors to influence the money is born the financing qualities in order to secure financial support to possess possessions purchases

- Multi-Friends financing & Mixed Use Loans- Doing 75% LTV.

- Merchandising, Place of work, Automobile, and you can Care about-Sites financing- Up to 70% LTV.

DSCR finance allow buyers to leverage the cash flow from their resource attributes so you can safe money to own property requests

- First time people is actually allowed! Finance for rent properties are made easy with Tidal Funds.

DSCR financing permit investors so you’re able to leverage the money is due the funding features in order to secure resource getting assets requests

- We funds all of our individual DSCR Mortgage loans to traders nationwide!

DSCR loans enable dealers so you’re able to leverage the money flow from its investment functions so you’re able to safe money having assets instructions

- Efficiency The audience is head individual lenders and you will agree all of our loans internally. The home income and cost are what we underwrite. As a result, we could intimate loans as fast as 7 business days once i’ve an entire file.

- EXPERIENCE You will find more than 50 years from joint knowledge of home purchasing, and you can credit. You will find and are usually on your own boots. Tidal Financing is here now so you can into front end, looking at their potential bargain to make certain your money was as well as getting a powerful return on the financial support.

Scaling the owning a home during the Colorado during the a critical pace are regarding nice advantages. Consider this, your total cost, in addition to one another pick and you will restoration, was $100,000. While the

renovation is carried out and you may a rental source of income secure, this new property’s appraised worthy of escalates so you’re able to $150,000. Most hard money lenders ft the loan amount with the financing to cost’ value if you decide to refinance within a great 12 months.

Unlike a normal loan that will only give you $75,000 according to research by the 1st rates, our very own Texas local rental property loan program allows you to acquire right up to help you 75% of your the fresh appraised value. what bank does small dollar loans It indicates, you could potentially potentially secure around $112,five-hundred, a lot more than a typical loan amount out of a home loan company. This advances our investor’s power to expand the collection swiftly, close even more product sales, and you will move a step nearer to monetary liberty thru inactive money. Its yet another loan option from the world of investment property financing, putting real estate dealers into the quick song to help you increased riches.

DSCR Loan FAQ

DSCR stands for debt provider visibility. Our very own Obligations Provider Exposure Proportion (DSCR) loan is a kind of Non-QM financial support popular within the a property assets. It tips the art of a great property’s earnings to cover their debt obligations. Debt burden as the home loan repayments. Rather than your earnings, as the dscr meaning for the financial create check your personal DT (debt to help you earnings ratio)I, i look at the property’s DSCR. In regards to our website subscribers seeking to keep its qualities unlike flipping it. You can expect good DSCR home long term financing inside the 29 otherwise forty season amortizations.

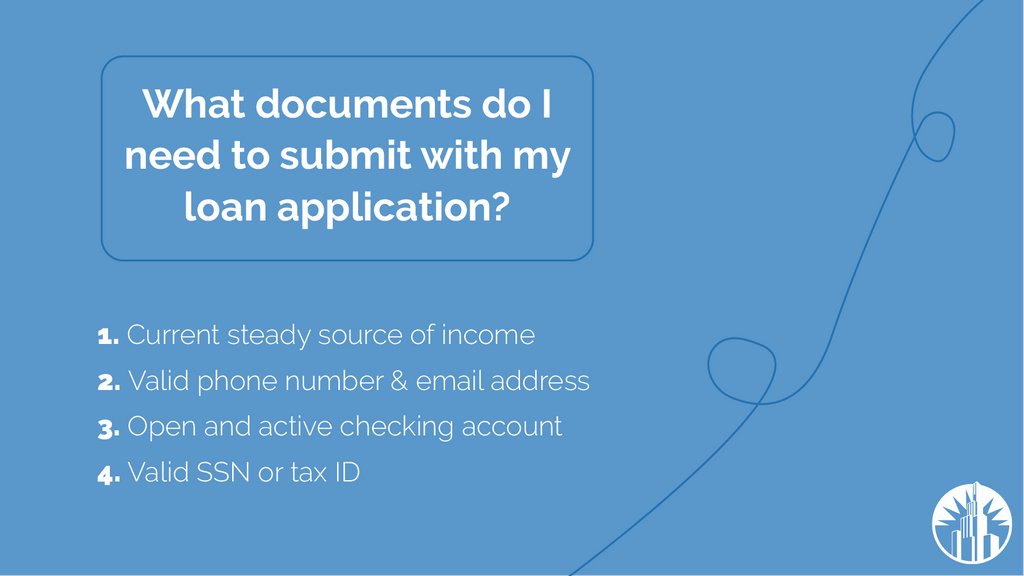

It’s quite an easy task to qualify for a loans solution proportion loan. I accept clients you to meet up with the following the criteria: . step 1.) An investment property that money streams in the a DSCR proportion more than .75. dos.) A rent in a position possessions. With very little deferred restoration. 3.) Credit history of at least 600.

DSCR (Personal debt Solution Publicity Ratio) financing are specifically readily available for money functions, offering a different sort of funding strategy. Having DSCR money, we gauge the property’s earnings possible instead of exclusively depending on the new borrower’s private money. The fresh leasing earnings produced by this new money spent plays an important character into the deciding financing qualifications and words. I assess activities such as for instance most recent and estimated local rental revenue, occupancy prices, and you will industry leasing rates (for short term accommodations) I estimate the debt Service Publicity Ratio from the isolating the newest property’s rental income by the anticipated full debt provider.