The way to get an unsecured loan Having a good Cosigner

Including a cosigner towards the personal loan software you will significantly increase your chances of approval, particularly if the cosigner enjoys an effective credit rating. A beneficial cosigner might help you be eligible for a diminished attention rates and you may a more impressive complete loan amount.

But not, a personal loan having a good cosigner is a little trickier so you can find and implement to own than just a regular personal loan. Keep reading to learn more about getting your own mortgage that have good cosigner.

See a cosigner and discuss mortgage knowledge

Locate a beneficial cosigner, check out people that believe your, like family otherwise best friends. Bear in mind, yet not, this body’s signing with the having a primary financial obligation. In the event that you miss payments, your own relationship with this person will be adversely impacted.

Once you’ve discovered a willing cosigner having a strong credit profile, discuss the prospective amount borrowed and you may words with these people to make sure shared arrangement about what try or isn’t acceptable. It’s adviseable to confer with your cosigner about what can happen if you fail to create mortgage repayments. Make sure that your cosigner completely understands the brand new financial commitment employed in cosigning a loan.

Likewise, know that although some unsecured loan loan providers make it cosigners so you’re able to come-off once a set amount of time, of a lot usually do not permit this after all. To eliminate a cosigner, you may need to re-finance your very own mortgage once the an individual borrower.

Check your credit history and you will personal debt-to-money ratio (DTI)

Before applying to possess an unsecured loan, understand where you are when it comes to eligibility. Of many lenders need at least credit history of 580, while some features stricter standards. You can examine your credit score 100% free once a week on the three major credit agencies (Equifax, Transunion and you can Experian). Make sure to see both your credit score along with your cosigner’s credit rating.

Loan providers also consider the debt-to-income ratio(DTI), and this ways exactly what portion of your own month-to-month earnings goes on the financial obligation payments such as expense or credit cards. Really loan providers like an effective DTI of forty% or down. Assess the DTI having fun with Money’s debt-to-earnings ratio publication.

Look around to find the best personal loan pricing

Compare personal bank loan cost regarding various reputable lenders, and federal financial institutions, borrowing unions an internet-based loan providers for example electronic banks and fellow-to-peer loan providers. To find out if a lender welcomes cosigners, seek out the business’s FAQ webpage on line or get in touch with support service.

When comparing financing selection, consider the doing apr (APR), as well as glance at installment terms, mortgage charge and you will capital big date. All of our self-help guide to an educated personal loans can help you rating come.

Note that there are two style of signature loans: protected and you can unsecured. Secured personal loans want collateral in the way of valuable individual assets, particularly property, car, brings or ties, if you’re signature loans do not. As well, secured finance will often have all the way down cost, however the likelihood of dropping private assets get outweigh the pros for the majority consumers.

Prequalify to possess an unsecured loan that have an excellent cosigner

After you apply for prequalification which have a lender, obtain possible mortgage cost and you may terms and conditions without undergoing a hard credit check. This enables one examine prices across the several lenders instead impacting your credit score.

But not, extremely online applications can handle individual borrowers, so you may be unable to enter into the cosigner’s recommendations. To find an excellent prequalified price filled with your cosigner’s info, you may have to get in touch with a loan company representative privately.

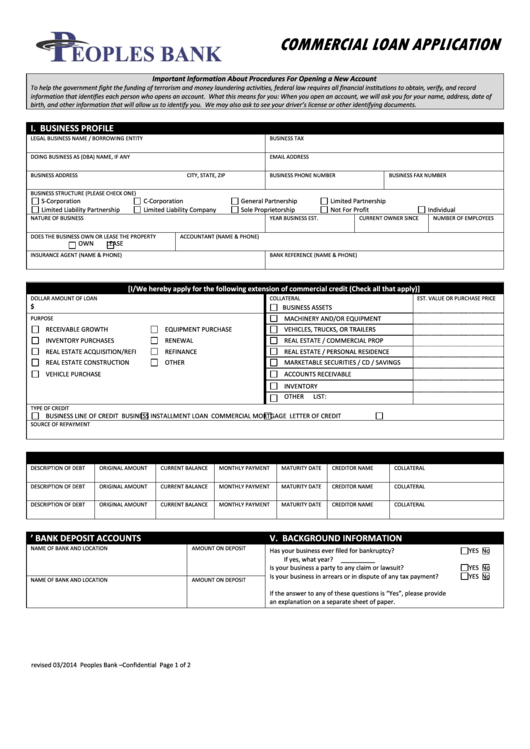

Apply for a consumer loan that have good cosigner

Choose the best prequalified price for you and you can formally pertain having you to definitely bank. Make sure to have got all the mandatory files for events, along with regulators-awarded images IDs, proof earnings, evidence of target and you may Societal Security amounts. Lenders also can demand bank comments from your own examining and you can offers accounts.

An official software comes to a difficult borrowing inquiry to you and you will your cosigner, so anticipate a small miss on your own credit ratings since an excellent impact.

Review the mortgage contract and you may accept the offer

- Apr (APR) – The eye you can easily pay for the mortgage, like the interest rate and you can people related costs.

- Charges – Find out if you’re being energized a keen origination fee or mortgage operating fee.

- Fixed interest rate or varying interest rate – A predetermined interest would not change-over the life span of one’s mortgage, when you find yourself a varying interest might have to go upwards otherwise off.

- Investment day – Particular loan providers promote exact same-big date money otherwise resource into the 2nd business day, although some can take up to each week so you can disburse loans.

- loans Dodge City

- Later costs – Observe how far the lending company costs for late costs.

- Amount borrowed – The total loan amount should echo one fees.

- Mortgage name – The newest extended your repayment identity, the greater number of attract you can easily spend total. But not, a shorter mortgage label results in higher monthly premiums.

- Prepayment penalty – Certain debt collectors cost you for those who pay the loan till the loan months stops.

- Payment terminology – Money tends to be month-to-month otherwise each week. Likewise, some lenders promote a cost savings to own automated write-offs from your own bank account (called autopay).

Or no of the words feel improper to you, talk to a customer care associate. Just remember that , youre less than no obligations to just accept that loan bring.

Get financed and start installment

According to the unsecured loan organization, you could potentially discover capital in 24 hours or less out of loan approval. Yet not, some lenders can take as much as weekly so you’re able to disburse financing.

Your repayments typically start regarding a month when you receive the mortgage continues. Opinion your payment agenda to be certain they aligns with your own personal fund desires – some lenders allow you to find the big date your own monthly or each week payments are designed.