Try a citizen mortgage suitable for myself?

- Full mortgage so you’re able to value of the house or property (how much cash security you have)

- Your credit character

- Your activities

Homeowner financing, comparable to standard mortgage loans, have been in a selection of factors. These are divided into repaired costs and you will adjustable costs. You might usually intend to just take possibly a two, 3 otherwise 5 year device based on what is best suited for the circumstances.

Certain homeowner loan repaired prices also have the main benefit of maybe not with one early installment charge. It indicates you might pay-off your loan any kind of time point.

Before going ahead with this particular particular financing you must have to be certain it will be the proper choice for you. For those who speak with a brokerage you to simply also offers secured loans, after that definitely that’s what you will be provided. But if you speak to our partners at the Chartwell Financial support, they’ll consider additional options you to definitely ple, you happen to be able to remortgage with a new financial and you can use the extra fund you would like. This might be generally the cheapest solution to raise funds.

An alternative choice which can be healthier are taking away even more lending together with your most recent lending company; when you find yourself halfway compliment of a product or service, you happen to be in a position to improve funds together with your present financial courtesy a further advance, according to cost, financing so you can worth and you will credit rating. Come across all of our book toward remortgaging to produce security.

Although not, in the event the a homeowner loan ends up your best option to you capable get a hold of the finest one to to your requirements.

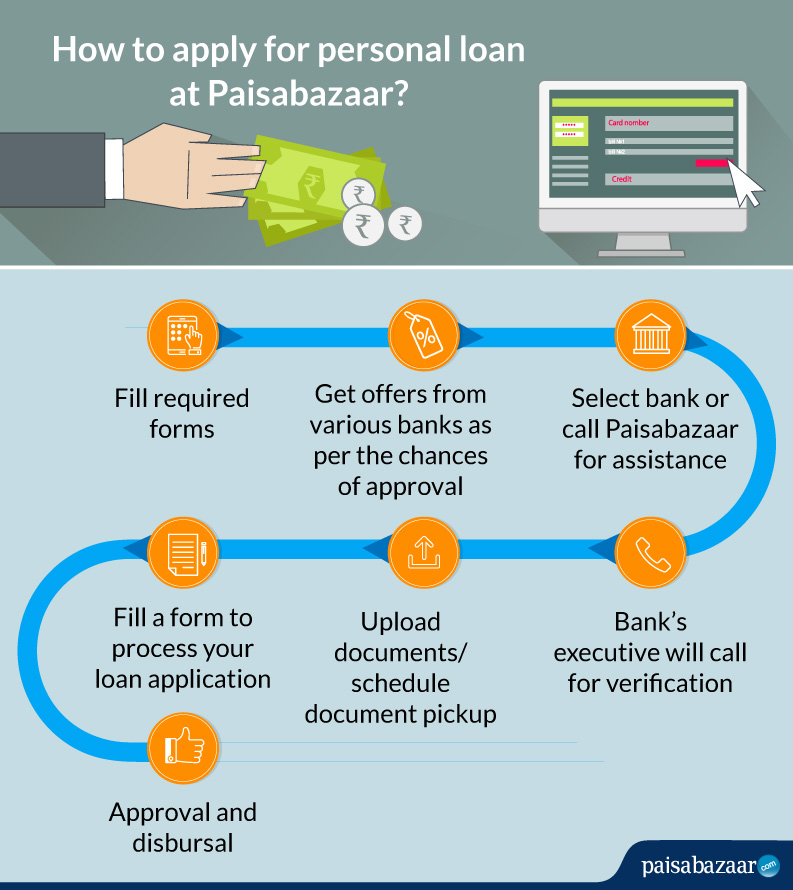

What’s the processes?

If you are considering a secured resident financing you will likely currently be used to just how taking a mortgage work personal loans Illinois. But with 2nd costs mortgages, what is the process?

- Shop around

As we determine a lot more than, step one might be studying whether a citizen loan is best selection for both you and when it is, be sure to find a very good resident loan offer from the talking to the couples at the Chartwell Capital.

- Decision in theory

Then, when you’re prepared to proceed the next thing is for your adviser to help you safer your choice in principle. 2nd, identical to which have home financing, when this is safeguarded, the adviser usually prepare your application. You’ll need to render data files just like your lender comments and payslips.

- Your application would-be believed

After they located your application the financial institution have a tendency to browse the pointers and you can data you have considering. They plus train a good valuation of the property to ensure its sufficient cover.

- You are getting a deal

And in case the lending company allows your application to suit your protected homeowner financing, they will certainly deliver a deal. They will certainly including publish a duplicate into the representative too.

- End

Once you have signed this new files for the shielded resident financing, both you and the lender commonly program a romantic date so you’re able to drawdown the fresh money it is called conclusion.

Swinging house or apartment with a resident mortgage

For many who promote your residence, you’ll want to repay your next fees financial until this new bank allows you to transfer next mortgage to a different property.

Benefits associated with resident finance

These types of financing is particularly very theraputic for residents that incapable of extend its current financial, or in which that isn’t favourable so they can exercise.

Avoiding higher early fees costs

If you need to improve loans but are halfway throughout your most recent mortgage identity, there may be a young cost charges to switch loan providers and increase your own borrowing from the bank. It can be cheaper to increase new finance need by way of a citizen loan to avoid the costs and then remark your options again towards the end of newest financial package.